If someone held you at gunpoint and demanded your money or your life, which would you choose? It’s a trick question. It implies that you have to choose one or the other. But what if you didn’t have to?

If someone held you at gunpoint and demanded your money or your life, which would you choose? It’s a trick question. It implies that you have to choose one or the other. But what if you didn’t have to?

“There is a way to approach life so that when asked “Your money or your life?” you say, ‘I’ll take both, thank you!'” ~Joe Dominguez and Vicki Robin

That’s why we’re here. We want both! That said, this book can be a tough read. It’s hard work. It asks some hard questions and sometimes presents viewpoints you might not completely agree with. It also has lots of homework! I ask you to slog through the hard parts, and commit yourself to getting through the book, so you too can say, “I’ll take both, please!”

Let’s get started.

The Old Road Map for Money

Joe & Vicki talk about the “old” road map for money, one that has its roots in the Industrial Revolution and really took hold after World War II. Most of us call it “the American Dream”.

It goes something like this:

- Go to work to make money

- Buy more stuff (often stuff we don’t need to impress people we don’t like)

- Work harder to pay for the stuff

- Retire and hope we live long enough to enjoy the stuff

We’re witnessing the unraveling of some of these concepts, such as the idea of retirement where the company takes care of you in your old age. Pensions are not common any more, and the few that are left are going bankrupt. A great local example here in Illinois are the teachers’ pensions. Our state is in the hole for billions of dollars that they cannot possibly pay back. They robbed the fund long ago, never fully paid it back, and now owe the interest that money was supposed to produce, plus the original money they took. What a mess.

How about Social Security? Most of us have been told since we were young that there would be none left by the time we reached the age to collect it. We were told that we were paying into a system that would be bankrupt long before we reached an age to collect it, or that the goals posts would be moved by then so we’d have to wait longer to collect it. This is already happening.

Many of the ideas behind the “Old Road Map for Money” come from concepts that are between 60 and 100 years old. Think about how much the world has changed since then. Think of how much the world has changed in just the past five or ten years. Most of us have children that never knew a world without internet, cell phones, and cable tv.

Yet, we’re still stuck in these old patterns of thinking. Why?

Making a Living vs Making a Dying

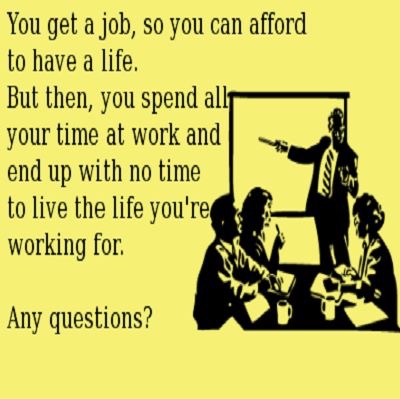

For many of us, our work days are consumed with activities related to money, even when we’re not on the clock:

- There’s the time it takes to get ready for work.

- The commute to work.

- The work day.

- The lunch hour (most people aren’t paid for this time).

- The commute home.

- The decompression time needed to recover from work.

- A scant amount of family time

- Preparation time for the next day, when everything starts all over again.

- There’s also the time and cost to procure the clothes, gas, food, and everything else connected to having a job.

- There are taxes to pay on the money you earn.

- There’s the cost to our health as well.

What’s left over? Not always a whole lot.

“How many people have you seen who are more alive at the end of the workday than they were at the beginning? Do we come home from our “making a living” activity with more life?…For many of us, isn’t the truth of it closer to “making a dying”? Aren’t we killing ourselves -our health, our relationships, our sense of joy and wonder- for our jobs? We are sacrificing our lives for money, but it’s happening so slowly that we barely notice.” ~ Joe Dominguez & Vicki Robin

The book asks two great questions:

- If we didn’t work, what would we do with our time?

- How much have we had to compromise our dreams in order to keep our funding or our job?

I’d ask one more: Do we even remember what those dreams were? When everything was fresh and new and we hadn’t given so much of ourselves away to pay the mortgage?

What Do We Have to Show For It?

What Do We Have to Show For It?

At the end of the day, what do we have to show for our efforts? An overwhelming amount of people live paycheck to paycheck. The answer for them would be not much. Somewhere along the line, the pursuit of the American Dream became a nightmare. We work to live a life that we don’t even have the time or energy to enjoy. We blink, and it’s gone.

What do we have to show for it at the end of our lives? We’ve all heard the question about what we’d look back and wish we’d done more of. According to The Top Five Regrets of Dying by Bronnie Ware, these are what people wished for on their death beds:

- They’d had the courage to live a life true to themselves, rather than the life others expected of them.

- They hadn’t worked so hard.

- They’d had the courage to express their feelings.

- They’d stayed in touch with friends.

- They’d let themselves be happier.

The big one I see missing from that list is spending more time with family, particularly children. As mothers, I don’t think we can ever spend enough time with our kids. They are grown and gone so fast. I blinked and my oldest two sons were adults. My third son just turned 18. He’ll be grown and gone soon too. That thought keeps me up at night!

My smallest children are 2 and 4. They have spent their entire little lives in daycare. School is not too far away. I’ll blink (again) only to find them walking across the stage to receive their diplomas. My heart aches knowing it goes so quickly.

So these questions hit home hard: What do we have to show for this daily grind? Doesn’t it actually leave us with so much less of what really matters? We can’t get our time back. We can’t get our life back. Once it’s gone, it’s gone. There are no refunds.

“We are working more but enjoying life less (and possibly enjoying less life as well). We have developed a national disease based on how we earn money.” ~ Joe Dominguez & Vicki Robin

So why do we do what we do?

“Everyone’s got a mortgage to pay.” ~ Nick Naylor in the movie “Thank You for Smoking”

“Debt is one of our main shackles. Our levels of debt and our lack of savings make the nine-to-five routine mandatory. Between the mortgage, car financing, and credit-card debts, we can’t afford to quit.” ~ Joe Dominguez & Vicki Robin

Essentially, we’re on a hamster wheel that we can’t afford to get off of. We work more to buy more, which means we must work even more. There is never an end point, just an endless circle, until one day we (hopefully) retired or win the lottery.

The same problem exists in other arenas that are based on the concept of “more” and never-ending expansion, growth and consumption- the economy, the environment, cheap food that robs us of our health, the practices to grow that food that rob the environment of its health. If more is better, than what we have is not enough. Unfortunately, more is never enough. We have moved from citizens and producers to consumers.

“We project onto money the capacity to fulfill our fantasies, allay our fears, soothe our pain and send us soaring to new heights. In fact, we moderns meet most of our needs, wants and desires through money. We buy everything from hope to happiness. We no longer live life. We consume it.” ~ Joe Dominguez & Vicki Robin

How then, shall we live?

In Star Trek terms, we’re in a “Kobayashi Maru”, a no win scenario. Captain Kirk found his way out of it by cheating. He changed the parameters of the test itself. But we don’t have to do that. Instead, we can change the entire map by creating a new one.

The Beginning of a New Road Map

It sounds too simple, doesn’t it? How can we just “change the map” and everything will be ok?

Because the map itself exists only in our minds. So much of what we believe and think we know about money is rooted in our thinking, our behavior and our belief patterns.

“Humans tend to create patterns of response. Some come from personal experience, primarily in the first five years of life. Some are genetic. Some are cultural. Some seem to be universal. Once a pattern is recorded, once it’s been tested and deemed useful for survival, it becomes very hard to change.” ~ Joe Dominguez & Vicki Robin

But which of these beliefs are superstitions and which are fact?

“Although we are largely unconscious of our financial belief system, our blindness condemns us to a prison of our own making.” ~ Joe Dominguez & Vicki Robin

We are trapped in prisons of our own design, holding prisons bars up to our faces, not knowing we are actually free. Is it possible to free ourselves from these prisons of our own thinking and conditioning? Our relationship with money is almost as complicated as we are. Perhaps the key that sets us free is to change our thinking. If the prison only exists in our minds, we can dissolve those prison bars with new thoughts and behaviors. And new dreams. And new maps! We hold the key to our own prisons because we created them in the first place. We need to give ourselves permission to set ourselves free.

To be free, we need to figure out what we believe that imprisoned us in the first place. And the best place to look is in our actions and patterns of behavior. They speak louder than words. Our behavior tells the story about our beliefs:

- When we feel depressed, lonely or unloved, we go buy something,

- When we want to celebrate good fortune, we go buy something.

- When we are bored, we go buy something.

- When we think there must be more to life, we go buy something.

Substitute other words for “buy”, and you’d be describing every addictive behavior on the plant. If something is good, bad, or whatever, we go do something, seeking external means to fill whatever is going on internally. It could be eating, shopping, or a host of other behaviors. I’d venture to say that emotional buying is even more powerful than emotional eating because we often don’t even recognize it as an addictive behavior.

This applies where you buy something from Macy’s or Salvation Army. It’s not the price, it’s the behavior behind it that matters. I write this, having just dropped $60 on stuff I “needed” at Goodwill. All good stuff, all bargains. But I have a houseful already. “Oh, I can just donate it back when I have too much,” I tell myself. Guess what? I already do. Something else is going on here.

“We have learned to seek external solutions to signals from the mind, heart, or soul that something is out of balance. We try to satisfy essentially psychological and spiritual needs with consumption at a physical level. How did this happen?” ~ Joe Dominguez & Vicki Robin

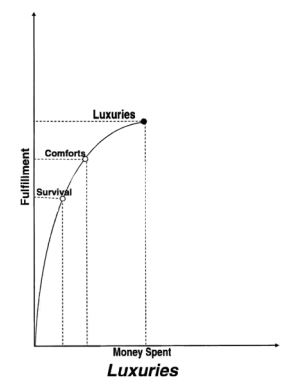

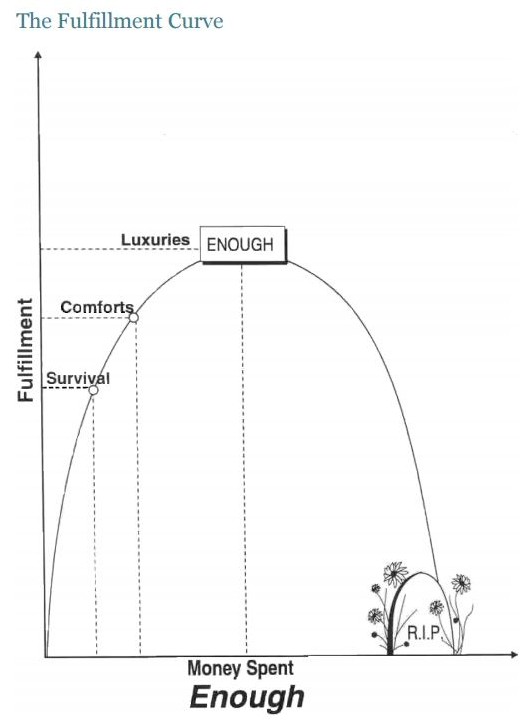

The Fulfillment Curve

We didn’t get here by accident. It’s embedded into us from an early age, for the sake of our own survival. A baby’s cry is biologically designed to get anyone without hearing range to act on his or her needs. It’s urgent and upsetting enough to call us to action. The baby learns that crying = something or someone from the outside will come and take care of him or her. As babies, our minds record this because it works. Our needs are met externally. As we grow, we make those connections about basic needs (survival), and then wants (comforts) and eventually desires (luxuries).

This happens over a long period of time and becomes so deeply ingrained in us, that it gets harder to discern between wants, needs, and desires. As the line blurs, so does the sense of satisfaction each one brings. Like a drug addiction, each high, or satisfaction costs more and wears off quicker. When we are young, we come to believe our needs had to be met externally and that more was better. This is biology at work- survival. But it perpetuates into adulthood and over our lifetime, often going unnoticed by our conscious minds.

“By now we believed that money equals fulfillment, so we barely noticed that curve had started to level out. On we went into life. House. Job. Family responsibilities. More money brought more worry…We hit a fulfillment ceiling and never recognized that the formula of money = fulfillment not only had stopped working but had started to work against us. No matter what we bough, the Fulfillment Curve kept heading down.” ~ Joe Dominguez & Vicki Robin

Something inside of us nags us that there is more. Our heart, our soul, longs for fulfillment. Not knowing what else to put there, we often fill those longings externally. We are filling the holes in our souls with stuff. It is the age old struggle of the physical and the metaphysical, really. The body and the heart/soul. What we often fail to realize is that the “more’ we are looking for isn’t physical. It isn’t external. That “something more” we long for is called by another name.

Enough- The Peak of the Curve

So how do we manage to stay in a place of satisfaction without always needing more and heading in a downward direction? The secret is: enough. It’s the basis for transforming our relationship with money. At the peak of the curve, we have enough- enough survival needs, comforts and luxuries to live a happy life without the never ending quest for more. We have everything we need, but nothing to “weigh us down, distract or distress us.” It frees us to follow things that are important to our hearts and souls.

“Enough is a fearless place. A trusting place. An honest and self-observant place. It’s appreciating and fully enjoying what money brings into your life and yet never purchasing anything that isn’t needed or wanted.” ~ Joe Dominguez & Vicki Robin

Wouldn’t it be lovely to get off the hamster wheel of “more”?

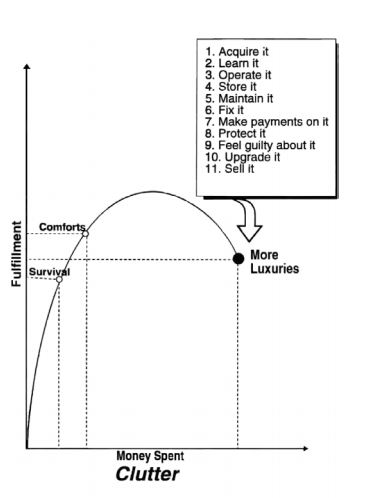

Clutter: A Fate Worse Than Death

What is clutter? Clutter is anything beyond enough, where the Fulfillment Curve heads downward. If you don’t need it, want it or love it, it’s clutter! It’s the physical evidence of the quest for more.

Clutter is anything that is excess- for you. It’s whatever you have that doesn’t serve you, yet takes up space in your world. To let go of clutter, then, is not deprivation; it’s lightening up and opening up space for something new to happen. As self-evident as these ideas may be, many people experience a subtle (or not so subtle) resistance to letting them in. This is why downscaling, frugality and thrift sound like deprivation, lack and need. On the contrary! Enough is a wide and stable plateau. It is a place of alertness, creativity and freedom. From this place, being suffocated under a mountain of clutter that must be stored, cleaned, moved, gotten rid of and paid for on time is a fate worse than death.” ~ Joe Dominguez & Vicki Robin

Clutter comes from seeking internal fulfillment from outer possessions. We know something is wrong and we reach for the familiar, what has always worked in the past. Something external. Inside, we are starving for something more. We are starving for authenticity, and a life that reflects our core values and who we are. In the process, we have built prisons for ourselves as we seek to fill that void with everything else- from money to stuff to food; and then we wonder what we’re overworked, stressed out, burned out, overweight, and in debt up to our eyeballs.

“Most clutter enters our lives through the “more is better” door. It comes from the disease of materialism, of looking for inner fulfillment in outer possessions.” ~ Joe Dominguez & Vicki Robin

The authors go on to talk about the famous “gazingus pin”. I remember first hearing about this in The Tightwad Gazette by Amy Dacyczyn. She was referring to this book. A “gazingus pin” is anything you can’t pass by without purchasing it. Often it’s that “one thing” you can’t resist. You buy it, bring it home, put it in a drawer with all your other gazingus pins, and forget about it until you’re out and see another one that you just “have to have”, and the whole process starts all over again until you have a house full of them.

Many people call these gazingus pins “collections”, and that’s all gazingus pins really do- they collect dust. Maybe it’s screwdrivers, or purses, or door knockers. Or video games, dolls, antiques, coins…the list goes on and on. In my husband’s case, it’s auto parts. He’s slowly taking over the basement. For me, it’s books. My books mostly gather dust, until the bookcase explodes! Apparently I’m rebuilding the great library of Alexandria. I also seem to collect dishes and kitchen gadgets at an alarming rate!

Often these items are physical evidence of deeper issues within. Sometimes it’s not that we don’t have “enough”, it’s that we don’t feel like we are enough.

Remember the show, “Hoarders”? Every person on that show had unaddressed emotional issues buried beneath all of their stuff. For some it was grief, for others, insecurity. For many, it was the sudden death of a loved one or a change of life thrust upon them unwillingly that they couldn’t adjust to. They could declutter all they wanted, but the clutter would reappear because they never addressed the real issues to begin with. Sometimes it’s much easier to hang onto what we don’t need, rather than to address what we do.

This happens with yo-yo dieting and addictions as well. My mother was a Weight Watchers counselor for many years, and was surprised to see so many overweight women she worked with struggling with issues of past sexual abuse. The weight acted as a shield and a barrier to keep people away. As the weight came off, these issues resurfaced, especially when others noticed them as attractive and even beautiful again. Some were able to work their way through their pasts and create wonderful new lives for themselves. Others put the weight back on and continued to hide.

Our internal, unaddressed issues can materialize as clutter, extra weight, debt, health issues and relationship issues. Some people collect spouses and friends at the rate others collect shoes. Whatever the type of clutter (or “baggage” if you will), it will often materialize in multiple areas of your life. Some of it will be easily visible- clutter, weight, health issues. Other types won’t- relationships, debt, activities, etc. But just because we can’t see it, doesn’t mean it isn’t clutter. Many people run themselves ragged with the clutter of activities that really serve no purpose but to stay busy.

Clutter can come in many forms:

- stuff

- activities

- sound/environmental

- weight

- debt

- relationships

- hobbies

“All of it is clutter— elements in your environment that don’t serve you yet take up space.” ~ Joe Dominguez & Vicki Robin

Clutter saps us of our vitality and our energy. Our things, our activities, all of our external clutter end up owning us rather than us owning them. The secret is to become aware of what is and isn’t clutter in your life, and get rid of the things that no longer serve you.

“As your awareness of clutter deepens, you’ll be inspired to spring-clean your whole life. As you follow the nine steps outlined in this book , you will develop your own personal definition of clutter and will slowly, painlessly, even joyfully, rid yourself of it. The first step will be to examine the past so you can understand and take responsibility for the present.” ~ Joe Dominguez & Vicki Robin

And that leads us into Step 1: Making Peace with the Past by Creating a Life Income and Personal Balance Sheet. (Note, this will go live on Wednesday, August 12).

Discussion Questions:

Here’s a summary of some of the questions I’ve posed in this article. Feel free to comment on whatever strikes you:

- What are your thoughts and observations about the “Old Road Map”?

- Is it frightening to think about creating a New Road Map that is unfamiliar?

- If we didn’t work, what would we do with our time?

- How much have we had to compromise our dreams in order to keep our funding or our job?

- My favorite question of all time: Do you remember who you were before the world told you who you should be?

- Who were you? What did you dream about doing with your life? Have you?

- What do we have to show for this daily grind?

- Why do we do what we do?

- What is your ‘gazingus pin’?

- Identify some areas of clutter in your life and share if you dare!

- What can you declutter from your life today?

The clutter part of Chapter 1 really hit home for me! My gazingus pin is definitely the books. That’s part of my clutter too, but seems like I have a lot of “stuff” I need to go through. We’re not too bad on activities, and relationships have pared themselves down over the busy years of my life with little ones. It’s definitely too much “stuff”. Even if I got a good deal on it, I’ve got too much of it.

Over the years I’ve had many kinds of jobs, but have been able to easily shed my job from my identity because I had the fortune of being home for so long with my older kids. I got to do many of the things I longed to do- write, draw, sing, garden, etc. I love to create things.

I would still love to conquer painting! I’m really enjoying learning more about photography right now, especially food photography for Frugal Foodie Moms.

My biggest issue is time, there’s never enough. And I’m tired of trading time for money. I want more. I want flexibility. I want to be able to work from anywhere and travel anywhere.

I also feel that ultimately, writing is my vocation. I love all the other stuff, but it’s writing that fulfills me the most and always has. Now, to figure out how to fit a life together around that! I’ve watched my mother try to do that for years. It’s a bit daunting!

Kim 🙂

Off topic but not – I have to somewhat disagree re: teachers’ pensions. IL pension problem has been building since the 1940s. “Double dipping” is a HUGE problem – aka retire from one public job, get another hence collecting pension and salary while building more “credits” towards yet another public pension. President Obama should not collect a state pension nor a senatorial pension once he starts collecting his presidential pension. Selena off soapbox, sorry. There are no easy answers to complex problems.

Let me start by saying who I am today is directly related to my upbringing. Lower middle class, working dad, stay at home mom. Parents who wanted their kids to have it better than they did. They were the oldest in their family as am I. On my father’s side, only him and his brother but his mother was a spendthrift. Didn’t take a rocket scientist to know why (her upbringing) but in his mother’s mind, he was “cheap”. Mother was oldest of 6 and saw her parents “helping” her siblings to the detriment of their retirement. Bottom line – I was raised to not buy things you could not afford. You might have to short term finance in a pinch, have a mortgage, and a maybe a car payment. I was 6 when dad bought his first new car, 37 before he bought his 2nd brand new passenger car (had purchased a couple of new 4WD vehicles over the years). You take good care of what you have.

Clutter – guilty about books but a number of years ago I learned to let go. I buy few books, new or used. And some are purchased after I borrowed them from the library. We used to make a trip to the bookstore weekly. The kids and I would go through the books on a semi-regular basis, donating to the library or garage sale. My husband still thinks we have too many but in reality, we have but a fraction of what we used to have.

Clutter – my husband thinks we had a lot of stuff when we moved. If I push him, he’ll admit we did not have as much as most people we know. When the kids were younger, I’d pay them 10-15% of the proceeds of the items they put on the garage sale. I had finally say if said item could be sold but it did motivate them. As they got older, they willingly went through clothes, toys, etc. to donate.

Clutter – when I was off work for 14 months, I tackled clutter, paper clutter that is. Paper, IMHO, is worse than books lol. I’ve never come up with a system to stay on top of it despite my best laid plans.

Clutter – Since I tend to be a tightwad, don’t like to shop (except for books) and I calculate how many hours I have to work to purchase an item, non-book/paper clutter isn’t too much of a problem. During my mental-health break (months I was unemployed, I was burned out), we recycled a lot of scrap metal, We also had opportunity to participate in a garage sale and went through the house top to bottom as well as the garage. The few items that did not sell were donated. Name of the game is said items did not come “home”.

While I may not have liked my employer, I always loved my job. And gave it my best but not to the detriment of my family but I’ve always been the bread winner. On the cutting edge of women being the bread winner.

Which brings me to this – I am a firm believer in marching to your own tune. Live the lifestyle you want, not what others expect of you. My car has over 200K miles. Still in good shape, gets me from A to B. Do I care if others think “gee, she must not be able to afford a new car” – heck no. I have a nice house, college educated kids, a job I love, and am happy in my own skin (okay, like most women, I want to lose 10 lbs).

I have a decent emergency fund, my kids are grown and out of the house. My salary covers expenses with money leftover. BUT I do not have it made. I need to make sure I have enough income during retirement. I am 15+ years away from my planned retirement. Longevity runs in my family. Direct relatives who took care of themselves lived to be 90 (on the “young” side) and I have a great-aunt who is pushing 96.

Not so much my money or my life but my money lasting me through my life. Life when working at a full-time job is not an option.

Selena,

I think we have a lot in common! Though I have more clutter and pounds to lose, LOL. I too have a car with over 200k on it, and I’m the same way- gets me from point A to B.

My parents raised me with lots of love but didn’t teach me much about money. So I had to learn that the hard way. We are all long lived in our family too, so making sure the money lasts a lifetime is definitely a goal!

Love this idea! I might use this with my younger kids as they get old enough to grasp the concept!

Kim 🙂

I remember the days of working full time with a two and five year old. Clutter creeps up on you but it does get better.

I also use the 10-15% come time for school supply shopping. As the kids got older, they really didn’t need a brand new box of crayons. Making good use of their back to school enthusiasm, we went through what was leftover from the prior year (or years, rulers last a long time). We could usually put a decent dent in the upcoming school year’s supply list. Tennis shoes were excluded but once the kids go so big, their outgrown PE shoes became my work-in-the-yard shoes. I just pitched the last pair the other day. Good for the budget and good for the environment – which most kids understand.

My college econ teacher told us that time is our most precious resource. We cannot make more time (or more land!).

He also said cost is not always money. More time than money, more money than time or the worst care, no time and no money. The no money and no time is not where any of us want to be.

How much is enough? For some in this country, they will never have enough money. It is a sickness IMHO. Some have more money than they could possibly ever need, much less spend. There is a break point for most of us and we all know money does not buy happiness. But a bit extra does make life less stressful.

Amen! I would add life energy too. Everything costs us some kind of effort or energy, which also is connected with our health. Some people literally work themselves to death, then lose the health needed to enjoy those things.

Kim 🙂

And I forgot another one of my life tenets – first rule of holes is to stop digging!

Definitely!

Reserved YMOYL from the library – I can’t remember when I first read it, I owned then donated it or borrowed from the library. We sold our prior house a couple of years ago and for the first time in 28 years, I was now a library “non-resident”. If I still had kids in school, I could get a card for free (IL state law).

IMHO, it is a steal at $120 per year (a new hardback cost at least $25 these days and paperbacks aren’t cheap either). You can pay for 6 months at a time, which I initially did. But come time to renew, I was still unemployed so I did not renew despite having the money to do so. A few months later I was employed again. But back to commuting 45 minutes each way, no option for flex hours (contracting position). A couple months later the dream job landed in my lap and only then did I renew, this time for a year.

Started reading YMOYL this morning, a statement in the introduction made me stop and think. “While the early adopters who did this program in the 1980s and 1990s are now more insulated than most against global instabilities, it is never too late to shift to a more frugal way of life”.

While we didn’t technically adopt their program per se, we did live below our means in the 80s (we weren’t making a lot of money at that time plus unemployment rate was 25% in our area at that time). We continued living below our means during the 90s. Times were good in the 90s but when we paid cash for what we bought despite the cornucopia of those extending credit.

We’ve weathered the “bubble bust” in 2001 and the financial crash of 2008 (which continues today to some extent for all except the top 2%). We did not escape unscathed but our frugal habits made this period a bit less painful.

Frugality became in fashion after the financial crash. I read plenty of articles about the “converts”, mostly those whose six figure plus bonus salaries were substantially cut or lost. But I wonder how many made it a life habit once the economy improved. I suspect maybe 20% continued.