We’re continuing our summary and discussion of Chapter 1 of Your Money or Your Life by Joe Dominguez and Vicki Robin. I wanted to dedicate an entire post to this exercise because it can easily get overwhelming. The authors clearly state that this step can actually be skipped for now and done later. But don’t skip it entirely. Knowledge is power, and the self-knowledge this step generates is very powerful. It can also be a nerve wracking roller coaster ride. So here it is:

We’re continuing our summary and discussion of Chapter 1 of Your Money or Your Life by Joe Dominguez and Vicki Robin. I wanted to dedicate an entire post to this exercise because it can easily get overwhelming. The authors clearly state that this step can actually be skipped for now and done later. But don’t skip it entirely. Knowledge is power, and the self-knowledge this step generates is very powerful. It can also be a nerve wracking roller coaster ride. So here it is:

Step 1: Making Peace with the Past:

- A:) Find out how much you have earned in your lifetime.

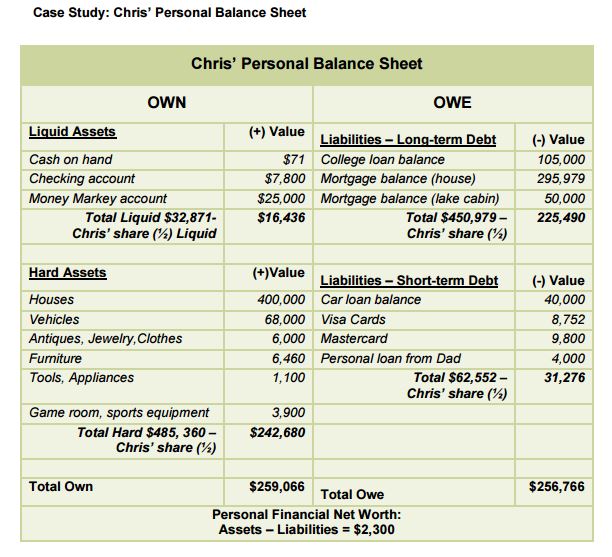

- B.) Find our your net worth by creating a personal balance sheets of assets and liabilities.

A.) Life Earnings:

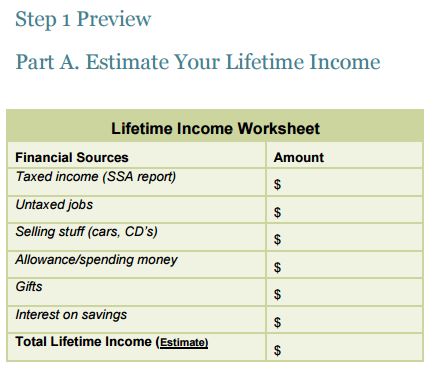

This is every penny you’ve made for your entire lifetime. That can seem overwhelming, so start with the easiest stuff- the taxable stuff. Check your tax returns or the annual statements from Social Security showing your recorded life wages are a great starting point. Here’s Financial Integrity.com’s checklist to help you get started:

- Locate your Social Security Administration (SSA) “Statement of Earnings.” The SSA sends out these statements annually. If you don’t have a recent copy you can visit your local SSA office or go to their website to request one.Your SSA statement lists your reported income since you started working

- Recall or gather records of money received that is not reflected in your SSA Statement.

- Find out the current balances on your bank accounts, loans and other debts. (Check your statements, call your bank).

- Get an idea of the current value of your house, car and other valuable possessions.

But Joe and Vicki urge you to dig deeper- write down those jobs that didn’t get taxed. Babysitting jobs, side jobs, under the table jobs, lawn mowing, birthday and Christmas cash gifts, you name it. The object is to get an accurate picture of all the money that’s ever entered your life. Most people have no idea what this number is. It’s enlightening to find out. Try to create as accurate a picture as you can. Estimate if you have to, but take the time to really dig deep. It pays off.

Remember: your life earnings represent just a number, not your number. ~Joe & Vicki Robin

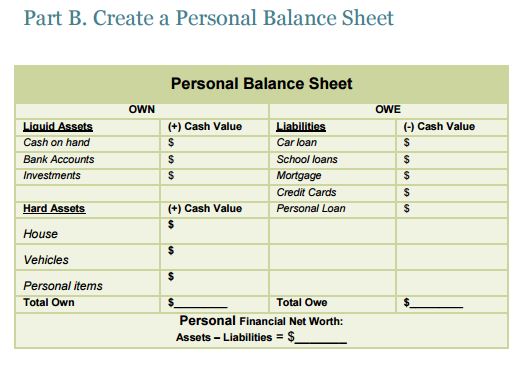

B.) What Do You Have to Show for It?

Many of us have been working for wages our entire adult lives. That means a certain amount of money has entered our lives. But what do we have to show for it? The difference between what’s entered our lives and what is left is our net worth.

Your net worth= total assets – total liabilities

The Personal Balance Sheet

This is the tough part folks. For some people, it may just take a few days, but if you’re a pack rat, like me, it may takes months to asses what your true net worth is. Take all the time you like, but don’t skip this step. The good news is, there’s a free spreadsheet to help you through this process! (The same site has a great resource called 31 Days to Organize Your Finances that’s worth checking out.)

You can also download the Financial Integrity guide for free. The Step 1 section has a lot of good examples. I’m posting a few screenshots here as well:

When you’re ready, come back and post your thoughts here. They can be totally anonymous. Just keep them honest.

Go through your material universe and list everything you own (assets) and everything you owe (liabilities)

Assets should include:

- Liquid Assets-cash or anything easily converted into cash

- Fixed Assets- physical possessions (literally EVERYTHING you own, and the resale value of it right now). Start with the big stuff- car, house, etc, but also include that riding lawn mower, your scrapbooking supplies, your dishes and housewares, the stuff in your garage, basement, your clothes. YES, everything! If you had to sell it now, what would it be worth? Check prices on Craigslist, eBay, Kelly blue book, etc. For me, this is the hardest part. I have a huge farmhouse FULL of stuff!

So much dissatisfaction comes from focusing on what we don’t have that the simple exercise of acknowledging what we do have can transform our outlook. ~Joe & Vicki Robin

What we focus on really does expand. How often are we counting our problems and not our blessings? This is an eye opening step to see how much we really DO have. It can also give you some ideas of what you may be able to get rid of later in this exercise to increase your net worth.

Liabilities should include everything you own, whether that debt is in money, goods or services. This includes loans, credit cards, and any bills that are outstanding (unpaid medical bills, back child support, etc)

Figure your net worth: Add all of your assets (liquid + fixed) and subtract your liabilities.

Whatever your find, it’s important to remember that net worth does not equal self worth. ~Joe & Vicki Robin

Discussion questions:

- What did you discover in this exercise?

- How did you feel doing the exercise?

- What would you change?

- What wouldn’t you change?

- How do you feel now?

Please feel free to add your thoughts and ideas below!

I had my SSA statement handy and “did the math”. A couple of things to think about:

1 – statement has SS wages and Medicare wages. The wage maximum that is subject to SS withholding is lower than the Medicare maximum. This dollar amount has changed over the years. So the two columns on your report may not match. Removing the cap on SS wages would go a long to shoring up the program long term (my personal opinion).

2 – And if the total number you get is not “depressing” enough, it dawned on me that SS wages are LOWERED by pre-tax deductions from my paycheck. So I really need to haul out all my tax returns (yes, I have all of them and yes, I can easily find and get to them). On one hand I think pulling tax returns is optional but on the other hand, it makes the reportable income number accurate.

Wow, Selena! I can easily get to my tax returns over the last several years (because they were done electronically), but farther back than that will be difficult. A lot of those were done on paper and before my divorce. No idea where any of those are. I figure I’m going to have to estimate off the SS statements.

I encourage everyone to get a copy of his/her SSA statement each year. The previous tax year doesn’t get posted until after April (FYI). We all need to verify our wages.

Speaking of verifying, another “Selena never knew” factoid. My husband is self-employed. His SS wages are (or I should say were since the recession basically killed his business) decreased by amount of money he put in his SEP (self-employed retirement plan). Plus since we file Schedule C, he also pays the “employer” portion of SS. We get to deduct the “employer” half but that only helps up to our tax bracket percentage.

Personally, this one is going to take me a while to do. because of the fixed assets. I have SO MUCH STUFF to inventory! 😮

The lifetime earnings, liquid assets and liabilities aren’t too bad for me. I know most of these already. But the fixed assets, wow, that’s a project- and definitely one I need to address!

Kim 🙂

Makes me glad we’ve downsized our book collection :).

Actually doing fixed assets is a win-win:

First, it helps us complete our net worth and two, this inventory should be used to see if you are under or over insured on home and auto.

If you have a mortgage, you are bound to insure it to meet your contractual obligation. But your homeowner’s policy may automatically increase each year. Mine does and I have them lower it back. Unless you would not be able to rebuild (zoning or flood plain), you do not have to purchase the land on which your home sits. Depending on the catastrophe, you may not have to replace the foundation or driveway. Be honest in your calculation. Contents and outbuildings are usually a percentage of the home. So if you have a lot of “stuff”, make sure it would be covered if you lower the amount of your home.

Auto – your vehicle may be worth more or less than you think. Easy enough to find book value online. But again, if a lien on the vehicle, you must maintain full coverage if your loan document indicates this.

I should have said re-purchase the land on which your home sits. I miss an edit function lol…

Selena,

I’m wondering if something is getting caught somewhere when you post. For some reason I’m always having to manually approve your comments, but the system is set up so once you’ve done two, they are automatically added.

And I think you should have an edit link on the top right hand corner of your post, next to the time. I do, but I’m an admin. Users should too though.

I changed over to the emailed commenting on this site about the time you started commenting and I’m wondering if there’s a permission issue somewhere. I’ll see if I can figure it out.

I don’t see an edit link, I tried “clicking” on the time but that did nothing. I try to proof read before I hit “post comment” but my brain is always faster than my fingers.

I think something’s goofy. And I agree- I type so fast, I HAVE to have an edit button! I’ll figure it out. Sorry for the inconvenience!

Kim 🙂

Make copies of your inventory list and keep them in a safe place, hoping you never need to use it to make a claim.

What have I discovered so far?

Even before hauling out the tax returns (a weekend activity), I’ve had it better than my parents. I know they were mortgage free by my age plus they had lived in the same home for 30 years. I’m not there yet.

Thankful I have only one liability, my mortgage.

A bit irked that had forces beyond my control tanked the economy in 2008. Then I reminded myself we weathered another recession. Living below our means during the good times was one of the main reasons.

What is the site rule for posting links? I’ve found a couple of home inventory check lists we might find useful. Looking for one in spreadsheet form (from a reliable source). I know there is software out there too but not sure if free or not (and I’d have to verify from a legitimate source).

If they’re useful, go ahead and post them. If you post more than 2 in a comment, the spam filters might catch it, but I can always pull it back out.

Kim 🙂

I can’t remember the syntax for posting links but hopefully this “fakes out” your spam filter.

Three links I found for free info. Two are spreadsheets, one is a PDF. Between the three, should get us all started on the detail needed to do our assets. We can customize as needed.

I did find some very nice software that is not expensive but not free. Ability to scan in pictures, receipts, and some can fill in or “better” info based on scanning bar codes. Another project for another day.

So here goes:

http://www.uphelp.org/pubs/how-create-home-inventory

http://www.vertex42.com/Files/download2/themed.php?file=home-inventory.xlsx

https://www.nycm.com/pdf/HomeContentsInventoryWorksheet.pdf

Thanks so much for taking the time to find these and post them, Selena! They look really good! Here is one that Financial Integrity.com had linked to that also looks good: http://www.insureuonline.org/home_inventory_checklist.pdf

And here is a link to Social Security’s online site, where you can create a site and track your earnings: http://www.socialsecurity.gov/myaccount/

Kim 🙂

PS One more, specifically for Canadians: https://www.desjardins.com/wcm/idc/documents/e35-bilan-perso-e.pdf

If you create an account on Social Security’s site, you can see all of your earnings that have ever been recorded towards social security: http://www.socialsecurity.gov/myaccount/

It’s pretty easy to set up and allows you to lock it down pretty tight.

Kim 🙂

Yes it does decent job of securing the information. You get three attempts to login then SSA says “three strikes” and your account is locked for 24 hours. So note to self: if you can’t remember the password, choose to reset after the 2nd failure lol..