Welcome to our first Frugal Moms² Book Club Discussion/Read Along! We’re glad to have you with us! Please note that there is still time to win one of two copies of our first book selection, Your Money or Your Life by Joe Dominguez and Vicki Robin! For full details, see this post.

The Book Club:

This is something new, so there’s bound to be some learning, stretching and mistakes involved (at least on my part!) Here’s what you can expect:

- Chapters: Every week, I’ll post a summary and discussion questions for the latest chapter. Some chapters are big and I may break up a chapter over a couple of posts, like this week.

- Pace: Feel free to follow along at your own pace. Do not worry if you fall behind! These posts will stay up. The important thing it to just keep going and add to the discussion when you can.

- Email subscriptions: You can sign up to get the full posts sent to you via email, and post comments by replying to the email! The sign up box is on the right hand side of all our pages, under “FMs Newsletter”.

- Commenting:

- Comment as much and as often as you like, but please keep it clean and civil.

- Your first two comments are moderated, but after that, they should show up right away.

- If you have problems with comments not showing up, contact me.

- You can comment by email! When you comment for the first time on a post, click the “participate by email” box (shown below). When you get a comment notification in your inbox, you can simply hit reply instead of having to come to the page to comment! (I love this feature!)

- Spam: Our spam queue is pretty good, and should keep out most spam comments, but sometimes legitimate stuff can get stuck in there too. Contact me if your comment didn’t show up, or if something made it through the spam filter.

- Commitment: Our first selection is a doozie. There may be times when you want to throw this book across the room. Or times when you don’t agree with the politics and view points of the authors. It may also cause you to look at things about yourself that you don’t want to see. But it’s definitely worth the struggle. The authors absolutely nail the psychology of money and how much it truly “costs” us in our lives.

- Resources: I’ll try to post relevant resources, especially to worksheets and tools online. Feel free to post any you find as well.

- Schedule: In October, we’ll be overlapping two different Book Club Selections so we can get Unplug the Christmas Machine in before Christmas.

- Disclosure: I’ve post Amazon affiliate links to the books if you want to buy them online. You don’t have to, but if you do, it helps support site costs. Get the books wherever you like: used book store, library, friend, whatever.

- Copyright: I love the books we’re about to discuss and have no desire to infringe on any copyrights. I’ll summarize and expound on main points in the chapters, add a few quotes directly from the books (credited of course) and post discussion questions.

The Book: Your Money or Your Life

Our first selection is Your Money or Your Life: 9 Steps for Transforming Your Relationship with Money and Achieving Financial Independence by Joe Dominguez and Vicki Robin. It’s a classic in the field of frugal living and financial independence, for good reason. It works. It asks tough questions and requires you to take a very hard look at some difficult things, but that is sometimes what it takes to transform your life, especially in an area as tricky as our relationship with money.

Our first selection is Your Money or Your Life: 9 Steps for Transforming Your Relationship with Money and Achieving Financial Independence by Joe Dominguez and Vicki Robin. It’s a classic in the field of frugal living and financial independence, for good reason. It works. It asks tough questions and requires you to take a very hard look at some difficult things, but that is sometimes what it takes to transform your life, especially in an area as tricky as our relationship with money.

The book has been around since the early 90s. The progam itself was founded in the early 80s through a company called The New Road Map Foundation, which is a non profit. You can find a complete history and many success stories on their website, Financial Integrity.org They are generously sharing their program guides, teacher guides, group study guides and more for free! We have full permission to use their materials under the Creative Commons license, so I’ll be pulling from those as well.

Please note: Week 1 is divided into three posts due to length:

Introduction/Prologue

Wk 1: The Money Trap

Step 1: Lifetime Income & Personal Balance Sheet

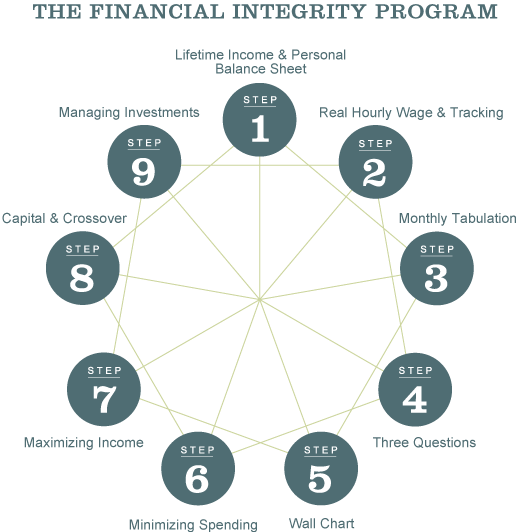

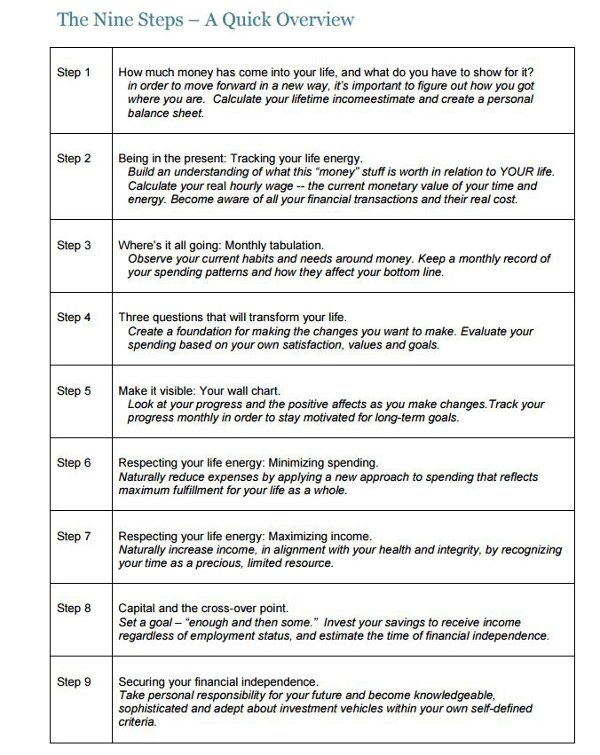

Overview: The Nine Steps

Here are the 9 Steps to Financial Integrity as explained here on Financial Integrity.com. Don’t be scared off! We’ll go through these step by step together every week. There are no deadlines and no one is selling anything. We’re all in this together!

Introduction

Really no surprises here. We all know things are not great out there. More people are in debt more than ever, our savings rate is at an all time low, and so is the happiness rate. Economically the world is in bad shape, as well as environmentally. We can turn on the news and see all of these things first hand. But you don’t even have to do that. Just log onto Facebook or any other social media. If it’s a big enough story, it will be plastered all over the place.

Prologue

The prologue of the book focuses on “managing your life as an integrated whole”, rather than in separate, unrelated compartments. Traditionally, money has been seen as something compartmentalized from the rest of our lives, but in truth it isn’t. Our relationship with money is often a complicated psychological and emotional dance between our past, present and future. Perhaps that’s what makes it so difficult sometimes to talk about. But money affects every area our lives, whether we like it or not, and every area affects our finances as well.

The purpose of this book is to transform your relationship with money. That relationship encompasses more than just your earning, spending, debts, and savings; it also includes the time these functions take in your life. In addition, your relationship with money is reflected in the sense or satisfaction and fulfillment that you get from your connection to your family, your community, and the planet. ~Joe Dominguez and Vicki Robin

This transformation includes reexamining the old financial road map and creating a new one.

This requires thinking outside the box, in new ways. These are defined as:

- Financially Independent Thinking– Applying consciousness to the flow of money by:

- examining basic assumptions you’ve adopted unconsciously

- evaluating the old financial road map

- learning to build a new map

- paving a new financial path that fits your life

- Financial Intelligence– the ability to step back and objectively observing your own assumptions and emotions about money

- Financial Integrity-learning the true impact of your earning and spending and tying it into your value system. Knowing how much is enough for you

- Financial Independence-anything that frees you from dependence on money to handle your life, including crippling financial beliefs, debts and social pressures

Discussion Questions: What brings you here?

These are from the beginning of the introduction, under “Why Read This Book?” You don’t have to answer all of these. Answer the ones you’re most comfortable with or that hit home and make you uncomfortable!

- Do you have enough money?

- Are you spending enough time with family and friends?

- Do you come home from your job full of life?

- Do you have time to participate in things you believe are worthwhile?

- If you were laid off from your job, would you see it as an opportunity?

- Are you satisfied with the contribution you have made to the world?

- Are you at peace with money?

- Does your job reflect your values?

- Do you have enough savings to see you through six months of normal living expenses?

- Is your life whole? Do all the pieces- your job, your expenditures, your relationships, your values- fit together?

Stay Tuned for:

Wk 1: The Money Trap (goes live on Tuesday)

Step 1: Lifetime Income & Personal Balance Sheet (goes live on Wednesday)

I guess I’ll go first. From many of my other posts here, you can pretty well gather that I’ve been in some kind of personal financial Armageddon for a while. No matter how frugal I am, I just keep getting hit with more crazy stuff.

I can survive most of it, but what I’m finding is that personally, I’m unhappy with how my life is structured right now. It doesn’t entirely fit my values. For instance, I don’t want to be working away from my children when they are at such young ages. It kills me every time I have to drop them off at daycare. They have spent their entire little lives in full time daycare. I want to be the one to raise my kids. I try to make the best of the time we have together, but everyone is tired in those few hours every night. I feel like I’m missing so much. And I can’t get it back. I know- I was blessed to be at home with my grown children when they were small.

All moms are working moms. Motherhood is a full time job. But for me, I never wanted to work outside the home while my kids were small, and wanted to be there when they were big too. I’m so glad I got to do that with the older ones. But this is killing me that I can’t give that to the younger ones. For many years, my hands have been tied because of other factors- child support for a while, and now my husband’s layoffs (twice in the past year). I have been the breadwinner for a long time, but unemployment throws a whole new wrench in it.

I have a good job that I don’t mind doing. I’m thankful I’m able to support my family. But it’s not the “contribution” I want to make to the world. There are about a thousand other things I’d rather be doing than being chained to a desk troubleshooting networks and computers all day long.

I’m also painfully aware of the passing of time. My kids are getting bigger, some have left home and I never get to see them. I’ve been over a thousand miles from my parents and my brothers since I left home 27 years ago. I want to see my kids and I desperately miss my extended family. I’ve been stuck in a state that I’m really not all that wild about for over 24 years. I want to at least be able to travel. But my current situation really doesn’t allow for that.

I do not come home full of life. I am just trying to survive it. That’s not how I want to spend the next year, five years, ten years. I don’t want to waste any more of my life like this. I want to thrive, not just survive. So I have a deep personal desire and commitment to do this program and figure out how to make it all work.

How about you?

Let me first say that day care is not bad – not bay for kids and not bad for society. My daughters were in daycare. A family member took care of the oldest kid until she was almost 3. Younger kid started day care at 7 months – 2 days a week at first, then 5 days a couple of months later. The younger kid met her best friend at day care – she was 14 months, her fried 7 months. Twenty five years later they are still close friends.

I will say quality child care is a must and I find it sad when a child is the first drop-off/last pick-up every day. We had the flexibility to drop off at a reasonable time and pick-up at a reasonable time. The center was but minutes from our home. We could also drop in at any time.

While I know this is not your plan, I tell you to not beat yourself up. You’ve already made step to change your life – you started up your website again.

Selena,

I agree, daycare is not bad, and my kids are in a good daycare, but they are the first there and the last picked up. They’ve been in daycare 10 hours a day since they were small babies. I’ve always had a 9 hour work day, plus commuting time. And at times, I’ve commuted very long distances with them. It’s not at all how I wanted to raise my kids or live my life, even though I have a good job and work with good people.

I absolutely hate not being in control of my time, feeling trapped and seeing it slip away over the months and years. Not how I want to live at all. I’m trying not to beat myself up, but that’s a challenge lol. Restarting the website was definitely a step in the right direction!

Kim 🙂

Is telecommuting an option for you? The Midwest is getting better re: telecommuting and flexible hours but still not as progressive as the coasts.

Also, since we are a 24 X 7 society, positions exist in IT that are not 8-5.

Couple of things to think about.

Not that this will make you feel much better but 10 hours is better than 12 hours.

Unfortunately it isn’t in my current job. I was able to do that somewhat in my last job. The only downside was that I was ALWAYS on call- for seven years!

Kim 🙂

I remember the recession of 1969/1970. I never knew how much my dad made but I knew what his earnings went towards each payday. His hours were cut at that time and things were tight. Roof over our head, food to eat, heat/utilities, and medical/dental.

If you include the aforementioned “mild” recession, I’ve lived through 7 recessions in my life. Two as a minor child, five as an adult. Got married during the reagan recession, unemployment was at 25% in my area. Manufacturing was hit hard and that was the economic engine of the area.

After four years of marriage, my husband started his own business. We based all life’s expenses on my income. It was a steady income with benefits. His business was self-supporting – we rarely borrowed money and even then, the payment could be made from my earnings if push came to shove.

Over the years I’ve changed jobs numerous times – outsourcing, company sold. A couple of years ago it was planned obsolescence (on my employers part). It was financially beneficial for me to stay to the end so I took some time off. I know have my dream job and we’re starting the next step in life.

My husband is older than I am and has always had a physical job. Politicians who think everyone should work to age 70 need to carry lumber or wrangle cement forms – they’d not last a week, much less to age 70. This last recession hit his industry hard and it will not hit pre-recession levels any time soon. He’ll start collecting social security (and the recession affected his and a lot of others ability to collect social security disability due to when credits must be “earned”). I put together spreadsheets and it is a long number of years before waiting to full retirement age would provide more money. We’ll use his social security to make extra house payments (saving money for taxes as it will be 85% taxable). Goal is to get the house paid off in five years. If not five years, seven is definitely doable.

I don’t plan to retire any time soon and don’t plan on collecting social security until I am age 70.

We put two kids through college – they were told we’d pay for four years of college. We did and we’re all debt free. Even though the kids sometimes rolled their eyes or “glazed” over, they are on good financial footing.

The game has changed today – it is not like it was when I first married. The reagan recession made transferring to a 4 year college out of the question for me. I went to work. And I’ve worked hard over the years.

But no matter what the economic times, one basic tenet holds true – live below your means when at all possible. This is how we survived the recessions of our adult lives. Some acquaintances think we have a big financial secret we’re not sharing. When you tell them live below your means, minimize debt, and do what works for you (e.g wife is breadwinner), they are skeptical. But it is nothing but the truth.

Have I spent money I wished I hadn’t – yes. It is water under the bridge and a lesson to be learned.

Selena,

That’s great that you all have had such detailed plans and stuck to them! Totally agree with living below your means. That’s what’s saving us right now with the unemployment.

So glad you have your dream job and am excited for you all as you work to pay off your house! That’s a dream in itself- no mortgage and a house to show for it!

Kim 🙂

It has not been a smooth ride nor have all my jobs been ones I loved. I did *not* want to take my 2nd to last job but again, recession time and two kids means you do what you have to do. The job did eventually provide a financial boon but the initial salary was a pay cut (even after removing the Chicago area salary factor).

Even when you have a husband that is okay with you being the breadwinner, society is not totally on board with it yet… it is getting better but has a way to go.

At the risk of sounding sexist, men have a more difficult time with unemployment/under employment. Some times this causes an untrue thought/issue/situation to be true in their minds. I’ve dealt with this since the financial crash – it doesn’t help when your spouse hits that hard employment age bracket of 55 and older.

Lots of good questions here.

◾Do you have enough money?

I honestly should, but I don’t. We live pretty much paycheck to paycheck. My husband was unemployed for about 4 years which really set us back. He went and got a degree and is now working in that field, but it’s not as well paid as his previous career. But, there is less commute and less stress (for him).

◾Are you spending enough time with family and friends?

I tend to be a bit of a loner, so I spend as much time as I can tolerate with family and I pretty much don’t have friends that I hang out with outside of work. Sounds pathetic, but it works for me.

◾Do you come home from your job full of life?

No, but that’s only because I work 12 hour shifts as a floor nurse. It tends to suck the life out of you. I come home exhausted, esp. since I have 2 hours of commute time each day I work. But, I do enjoy my job, for what it’s worth.

◾Do you have time to participate in things you believe are worthwhile?

Yes. I only work 3 days most weeks. Sometimes it’s only the two days that are required, sometimes it’s 4 days. My problem wouldn’t be time, it would be not letting unimportant things take up my time.

◾If you were laid off from your job, would you see it as an opportunity?

No. I’ve been a nurse for 25 years. It’s not just a job, it’s who I am. I’m sure as I get older, floor nursing is going to be too taxing, but I’m sure that I would find something in a related field.

◾Are you satisfied with the contribution you have made to the world?

I help mothers transition into their role. It’s a good contribution to life.

◾Are you at peace with money?

NO.

◾Does your job reflect your values?

Yes.

◾Do you have enough savings to see you through six months of normal living expenses?

I don’t even have enough money to see me through a month, let alone six months. That’s what I want to improve on.

◾Is your life whole? Do all the pieces- your job, your expenditures, your relationships, your values- fit together

As good as it’s going to get right now. There’s relationship issues to work on and I’m about to send my oldest child to college, so I’m in a transition stage right now.

Debbie,

Sounds like you have a wonderful and fulfilling job that gives you a lot of flexibility and has helped you through the bumps along the road financially.

I hear you on not socializing much outside of work. I really don’t have the opportunity to do that right now, and haven’t lived in this area long. Haven’t been able to put down new roots yet. I figure that will take time.

Six months of living expenses in the bank sure would be nice. I’ve had my emergency funds wiped out and rebuilt so many times that I feel like I’m on a money merry go round! LOL

Kim 🙂

I don’t socialize outside of work much either and I’ve lived in this area my entire life. We are close to family though we minimize seeing toxic members (we see them at funerals).

It is a challenge to build an emergency fund when you need every penny of your paycheck to pay bills/living expenses. And for a lot of people, their expenses are bare bones, no frills.

I’m not so sure getting a 2nd job is the answer either – there are only so many hours in a day and every job has some type of cost.

I read this statement years ago:

All money is meant to be spent, just a matter of when.

Ooh, that’s good!

And I forgot to say that all moms are working moms. Every time I heard “Dr.” Laura and her listeners haughtily say “I am my kids mom”, I wanted to smack them upside the head. Like a mom who works outside the home says “whew, no mom stuff for me for X number of hours”. Nothing could be farther from the truth.

I agree. Motherhood is a job in itself. The hardest one ever, but very rewarding too.

Kim 🙂